I get that anything is worth whatever someone is willing to pay for it. That’s besides the point. My point is, beyond speculation, what do crypto coins represent?

I also understand that the value of the US dollar is being questioned almost as much without the backing of gold.

But what I really want to know is what is at the foundation level of Bitcoin that people are buying into?

I have a basic understanding of the blockchain, etc. I sold 1BTC in 2017 for $1200 when I thought that was as high as it would go. At this point, at over $100kUSD and rising steadily, what is the $ limit and what is that limit based upon? I thought it was based on the value of mining to check transactions but this seems… not worth $100k to me.

I’ve been thinking, the only tangible value I personally see in Bitcoin, because it’s not really being used as legitimate currency, is for criminals. By now, there must be trillions of dollars in BTC acquired by criminals holding corporations hostage. When you’ve got people like Trump involved (either explicitly or by way of manipulation) with an executive order to establish a crypto czar, this suggests to me that he’s creating pathways for bad actors to more effectively gain more wealth. These are the people who are most excited in Bitcoin, beyond speculation.

I mean, there’s little to nothing on the up and up with crypto, right? It’s a scam. Right?

Please, factual answers only. I’m looking for someone to dispel my speculation with genuine economics of the matter.

Cryptocurrencies don’t rely on a central entity and is the Lemmy equivalent to Reddit compared to the fiat currency. I like it and I like the technology but

- Good luck at having a proper stable economy using only crypto. Cryptobros hate central banks but their policies ensure that a loaf of bread doesn’t cost 3 times as much the next day. I’d rather have a central trusted authority than not having one

- Bitcoin by itself sucks. It was the first crypto so it’s the most common but it’s slow, heavy and costly to operate and to transact on

Cryptobros hate central banks but their policies ensure that a loaf of bread doesn’t cost 3 times as much the next day.

The exact opposite. Only after abandoning the gold standard does a central bank have the power to make a loaf of bread cost 3 times as much the next day.

Central banks are a relatively new invention and are not essential in the slightest.

They are able to regulate the interest rate. We don’t perceive a change of value of our fiat on a regular basis. What yesterday was $1, today is $1.0000001. Good luck maintaining the same purchasing power with Bitcoin (in terms of stability)

not even fiat (heh) is worth anything if we don’t accept it as store of value, let alone an electronic register on a digital ledger.

the only tangible value I personally see in Bitcoin, because it’s not really being used as legitimate currency, is for criminals.

Please, factual answers only.

In 2021, 0.15% of known cryptocurrency transactions conducted were involved in illicit activities like cybercrime, money laundering and terrorism financing

You’re gonna have to give me a source for that buddy.

It came from here but this source has more detail.

sounds like the word “known” is doing some heavy lifting there

Is that by total number of transactions or by bitcoin volume?

I copied that from Wikipedia which got their reference from through NY times.

For specific details, this is probably a better source https://www.trmlabs.com/resources/reports/the-illicit-crypto-ecosystem-report-2022

My views on it are the same as the DPRK. A tool used by capitalists that can help fight against capitalism.

Can you provide a source? I haven’t heard that perspective before but it sounds interesting

https://www.thecoinrepublic.com/2025/03/16/north-korea-bitcoin-holdings-top-el-salvador-bhutan-after-bybit-hack/ basically, DPRK hackers constantly steal bitcoin from insecure exchanges or whatever. This helps them get around the genocidal sanctions the west places on them. It isn’t disclosed what they use the funds for, but likely in trade with Russia and/or China.

There is a limited amount of Bitcoin, and some of it is lost in forgotten wallets, so the total volume is constantly falling. This may partially increase the price.

But in reality, as in any speculative market, the price of bitcoin depends mainly on faith in it and speculation about world events (some kind of cataclysms, regular statements of this or that person about cryptocurrency, etc.)

The main real value can only be found in countries that are disconnected from SWIFT. However, almost no one appreciates this because there are only 5 officially disconnected countries. However, if this list continues to grow, cryptocurrencies (including Bitcoin) will become more prevalent in international transactions.

The cost to produce new bitcoin doubles every 4 years ( a bit more because new hardware is added). This drags up the price of all the dormant bitcoin.

There have been no new Bitcoins for a long time. Everything that miners mine is just a transaction tax. In fact, to describe the reason for bitcoin’s growth, you need to understand what money is all about. Not just crypto money, but in general. In short, the price is rising because many (including miners) believe that it will rise and do not spend bitcoins. In a normal economy (except Japan), you could just print more money and the price would drop because the currency unit would depreciate. But bitcoin is a mathematical model, and it has a limit. You will not be able to create more Bitcoins than you have already created in any way. Therefore, the belief in the growth and retention of the currency reduces turnover and the price increases. If any of the whales withdraw their entire stock in one day, the market will fall for many years.

UPD: Excuse me, I really made a mistake. You can still mine 3 bitcoins per block… but to be honest, 3 bitcoins for a whole pool is only an eighth of the original 25 bitcoins per person. In general, mining has not compensated for mining for a long time.

UPD: I checked just in case. The average commission payment is now 1.5 bitcoins. almost half of the reward

UPD: I will reveal my thought even more. An ASIC at 1160 Th/s costs 33k dollars and consumes 11 kW. Even in my region with a low-cost light (only 5 cents per kW), such an asic will be able to bring only 58 dollars per day. And it will pay off only in 1.7 years. This is the moment when the miner will FINALLY stop working at a loss. And this is in ideal conditions without increasing the complexity of the network and other things. So all the miners who don’t buy huge amounts in bulk barely pay for their business.

mining has not compensated for mining for a long time.

The average commission payment is now 1.5 bitcoins. almost half of the reward

I think you have the wrong units. The average fee is 1.5 USD.

And it will pay off only in 1.7 years

This is quite quick. Last time I looked the it was around 3 years. Most of the cost comes from buying the hardware.

I think you have the wrong units. The average fee is 1.5 USD.

https://bitinfocharts.com/ru/comparison/bitcoin-fee_to_reward.html#3m

Percents you can calculate self. That’s not for all blocks, but in a day.

UPD: This is not for every block, of course, but for the whole day. I was wrong about that. Maybe really 2%

Ballpark calculations

Winning a block gets you 3.125 BTC + approx. 0.06BTC in fees (2%). $6000 in transactions fees with 4000 transactions per block = $1.50 per transaction.

This is quite quick. Last time I looked the it was around 3 years. Most of the cost comes from buying the hardware.

my calculations were made without taking into account the growth of the network’s complexity. So, when I tried it last time, the network’s complexity had increased so much in a year and a half that the equipment was not bringing in much, and it was not worth the risk of investing. However, things may be different now, and I may be mistaken.

UPD: Now I just buy Bitcoin on exchanges, and it brings me the same % of income as mining. But I don’t have to deal with equipment, follow ridiculous laws, or waste electricity. =) That’s why I say that many peole just tkabe bitclin to cold wallets. Less bitcloin exists on exchage then grow price.

When I first looked at Bitcoin it was around $10/BTC and electricity to mine (on a cpu) was about the same.

The people who make money mining bitcoin have a combination of very cheap electricity and/or next generation asic hardware.

and yes, I also mined bitcoins on the CPU. back when you could get near 200 bitcoins per hour of work. After that I mined altcoins on video cards, mined through nicehash. what I have not mined. and I can say - it’s all thrown money. much, much more profitable just to buy cryptocurrency and hold on cold wallet.

if you don’t want to tell me that people are setting up mining farms in Somalia (because it’s pointless from a risk perspective), I don’t think electricity rates are particularly lower anywhere else.

In any case, you can make money from anything. It’s just that the risks associated with mining don’t justify the investment. That’s all.

Part of my last minig farm, if you interesting.

It had the same value a stock without a dividend has.

Bitcoin doesn’t even attract criminals as it’s traceable. You can easily tell who bought what and traded what. Since all the exchanges are KYC, no criminal worth their salt would use Bitcoin. Instead, they would rather use Monero. The only people buying and selling Bitcoin are people who want to gamble on it getting higher

Just like anything else, it’s worth what people are willing to pay for it vs what people are willing to buy it for.

Currently bitcoin is just a digital commodity with a finite supply which makes it a good store of value if people continue to use it.

The thing is, there’s nothing preventing bitcoin from tanking and becoming essentially worthless besides people buying it because the price is low.

If in a hypothetical future the bitcoin price becomes stable then it will become a valuable commodity. It’s value is wholly derived from it’s users and nothing else.

It’s not very convinent for governments or large institutions to hold it in it’s current form since it’s too easy to steal without leaving a trace. For government use there is going to be needed some development to allow for government or Central banks to have complete control over the currency without giving that control away which I think might be possible. In that case settling international transactions in bitcoin as opposed to the dollar for BRICS countries might be an option which doesn’t use the US dollar.

All the other uses IMO are pretty much fluff such as paying in bitcoin.

More than dollars.

It’s value is in remittance if nothing else. It’s cheaper than western union. But the network is only “cheaper” in that way because it has distributed the costs of running the network to the speculating miners who solve pointless puzzles with monsterously greedy processing farms hoping to win the lottery and get back more than they put in. It’s a ponzi scheme, it takes more from everyone who came later and gives the value to early adopters who were there when you could solo mine coins with whatever hardware and a bitcoin was worth 7 dollars in exchange. Look up how many coins Satoshi is supposedly holding. If they were to cash out even a small fraction the whole market would crash. So use it as a remittance service but not an asset if you must. This from someone who mined 27k worth of it back when it was 7$ and spent it all on illicit medical cannabis before it inflated to 50k

I believe I’ve seen recent cost analysis of using crypto exchanges to transfer money across international borders instead of doing direct conversion through whatever “classical” money transfer service and it showed that due to exchange rates, price fluctuations between crypto exchanges, gas fees, and fiat exchange rates into and out of crypto from usd to whatever currency of the recipient its actually tangibly cheaper to just use a direct wire transfer and currency exchange.

I’ll have to see if I saved the post with the price breakdowns to send you but I just wanted to share that in case you hadn’t heard about it yet. If you had seen that and did find it cheaper somewhere else I’d also be interested to hear where it is actually cheaper. That’s just the most recent analysis I had seen of the costs to exchange from fiat to crypto, send internationally, and then withdraw it in the native currency.

Rip to the millions you smoked away btw lol I would’ve done the exact same honestly

USD FX pairs are currently cheaper using traditional transfers.

However going from a non G20 currency to another non G20 currency can be much cheaper using crypto.

Ah thats interesting, yeah the study i saw was specifically looking at usd to pesos. Good to know!

So you know how fiat currency is backed by nothing more than the fact the government says it’s valuable and we all agree to that? Crypto is sort of like that except without the government bit

Fiat currency is backed by taxation, which can only be paid in the very same currency that the taxer prints.

📺 Your Taxes Pay for NothingSome states have been looking into allowing you to pay your taxes with crypto, so checkmate atheists.

No stable state with a strong currency would ever do that.

Based on … What exactly? Your gut feelings?

But I can buy anything with fiat curency and with bitcoin I can basically buy nothing. And I never will be able probably, bitcoin is too slow to be used as an actual curency to buy common things like groceries

People buy big ticket items like cars and houses with bitcoin, not chocolate bars.

The US dollar actually is tied to something of value: it’s the format the us government will take their taxes in or else they will increasingly use their powers as a monopoly on fhe legitimate use of force until you give them what you owe

Crypto is only worth what others will pay for it. Which is why I don’t own it

Further to that it is also what they pay their debt in. You can buy debt in dollars and earn interest in dollars

This is a negative for dollars, not a positive.

Being able to inflate your way out of debt makes a currency less valuable.

In value yes, but as a tool it’s very valuable

Valuable to the people creating debt in that currency. Not to other stakeholders.

I was shooting heroin and reading “The Fountainhead” in the front seat of my privately owned police cruiser when a call came in. I put a quarter in the radio to activate it. It was the chief.

“Bad news, detective. We got a situation.”

“What? Is the mayor trying to ban trans fats again?”

“Worse. Somebody just stole four hundred and forty-seven million dollars’ worth of bitcoins.”

The heroin needle practically fell out of my arm. “What kind of monster would do something like that? Bitcoins are the ultimate currency: virtual, anonymous, stateless. They represent true economic freedom, not subject to arbitrary manipulation by any government. Do we have any leads?”

“Not yet. But mark my words: we’re going to figure out who did this and we’re going to take them down … provided someone pays us a fair market rate to do so.”

“Easy, chief,” I said. “Any rate the market offers is, by definition, fair.” He laughed. “That’s why you’re the best I got, Lisowski. Now you get out there and find those bitcoins.”

“Don’t worry,” I said. “I’m on it.”

I put a quarter in the siren. Ten minutes later, I was on the scene. It was a normal office building, strangled on all sides by public sidewalks. I hopped over them and went inside.

“Home Depot™ Presents the Police!®” I said, flashing my badge and my gun and a small picture of Ron Paul. “Nobody move unless you want to!” They didn’t.

“Now, which one of you punks is going to pay me to investigate this crime?” No one spoke up.

“Come on,” I said. “Don’t you all understand that the protection of private property is the foundation of all personal liberty?”

It didn’t seem like they did.

“Seriously, guys. Without a strong economic motivator, I’m just going to stand here and not solve this case. Cash is fine, but I prefer being paid in gold bullion or autographed Penn Jillette posters.”

Nothing. These people were stonewalling me. It almost seemed like they didn’t care that a fortune in computer money invented to buy drugs was missing.

I figured I could wait them out. I lit several cigarettes indoors. A pregnant lady coughed, and I told her that secondhand smoke is a myth. Just then, a man in glasses made a break for it.

“Subway™ Eat Fresh and Freeze, Scumbag!®” I yelled.

Too late. He was already out the front door. I went after him.

“Stop right there!” I yelled as I ran. He was faster than me because I always try to avoid stepping on public sidewalks. Our country needs a private-sidewalk voucher system, but, thanks to the incestuous interplay between our corrupt federal government and the public-sidewalk lobby, it will never happen.

I was losing him. “Listen, I’ll pay you to stop!” I yelled. “What would you consider an appropriate price point for stopping? I’ll offer you a thirteenth of an ounce of gold and a gently worn ‘Bob Barr ‘08’ extra-large long-sleeved men’s T-shirt!”

He turned. In his hand was a revolver that the Constitution said he had every right to own. He fired at me and missed. I pulled my own gun, put a quarter in it, and fired back. The bullet lodged in a U.S.P.S. mailbox less than a foot from his head. I shot the mailbox again, on purpose.

“All right, all right!” the man yelled, throwing down his weapon. “I give up, cop! I confess: I took the bitcoins.”

“Why’d you do it?” I asked, as I slapped a pair of Oikos™ Greek Yogurt Presents Handcuffs® on the guy.

“Because I was afraid.”

“Afraid?”

“Afraid of an economic future free from the pernicious meddling of central bankers,” he said. “I’m a central banker.”

I wanted to coldcock the guy. Years ago, a central banker killed my partner. Instead, I shook my head.

“Let this be a message to all your central-banker friends out on the street,” I said. “No matter how many bitcoins you steal, you’ll never take away the dream of an open society based on the principles of personal and economic freedom.”

He nodded, because he knew I was right. Then he swiped his credit card to pay me for arresting him.

This is actually quite good. OC? / Source?

It was an article published in the New Yorker in about 2014 or 2015.

i’m glad you said that, i was confused if this was either an apocryphal from ayn rand… or the great nagus, who knows.

since it’s making fun of an Ayn Rand book in the very beginning, it’s safe to assume it’s not her work. And the grand Nagus doesn’t really approve of drug use. Except for beetle snuff.

I keep this copypasta around for occasions such as these.

At its core, it represents an irreversible proof of digital existance. Blockchain is the only technology that can do this, and it makes it more valuable than you’d think.

Bitcoin itself has first mover advantage, and that keeps it on top. It’s hard to point to any particular feature of bitcoin that warrants this first place position, aside from pure decentralization of holdings.

The irreversibility of blockchain transactions is very underrated to most of us, but think about it… no bank or government, even with military involvement, can reverse a transaction or seize assets. For most of us in nations with sophisticated financial infrastructure and govt, this doesn’t sound like a big deal, but for the majority of the world, this is a huge deal.

It also represents freedom from fiat. Since the beginning of currency govts have used it as a means to extract wealth from the populace. Printing, confiscating, and controlling as it pleases them. We’ve historically used gold to hedge against this, and there’s even instances in history where govts have devalued and confiscated gold as a means of supporting itself. Bitcoin brings all the freedom of gold, with all the benefits of the digital world.

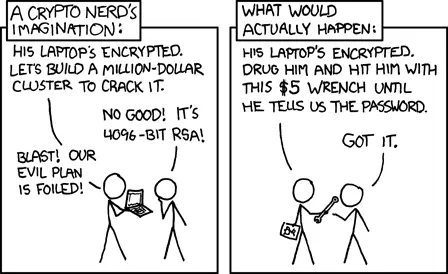

Almost relevant XKCD

There’s many defenses around a $5 wrench attack. But in the end, no, crypto doesn’t fix crime.

Paper money isn’t worth anything innately. Gold isn’t either. Not diamonds. Nothing has innate worth except food, air, drinking water, and possibly shelter.

Gold and diamonds have intrinsic value

Gold is needed for computer parts, and diamonds are used for cutting

They are more than just shiny

Their value will “never” hit 0 (Bitcoin would be worthless without gold for computers)

Yes, we could find substitutes in the future, but for the substances to not be useful somehow is so low and would have to be an apocalyptic scenario. And in an apocalypse, gold could even be worth more.

…Except that gold, like the dollar, and like bitcoin, has the value it does because people believe it does. Sure, gold’s a great semiconductor. But if that was all we used it for, the price of gold would be a tine fraction of what it is. Diamonds are great as abrasives and in certain cutting applications, but that’s all synthetic now. Natural diamonds only have high value because of artificial scarcity and advertising.

But if that was all we used it for, the price of gold would be a tine fraction of what it is

That’s intrinsic value.

Yes.

But many people–and I’m not saying you do this–but many people get gold, silver, and diamonds confused, and think that their intrinsic value is linked to their perceived value. does that make sense?

I get that

I wouldn’t buy diamonds or gold hoping they increase in price just as much as I wouldn’t buy bitcoin to do the same.

If you offered me 1USD in Gold, Diamond, or Bitcoin.

I would take the gold. It has the most intrinsic value.

The probably that gold hits 0USD is less than bitcoin hitting 0USD.

The only reason you’d take bitcoin is if you think that it has a higher ceiling. Intrinsic value is the floor. But that is gambling

I opt for bitcoin because it has more utility value for me.

My bank makes it an enormous pain in my ass to buy things from overseas vendors; they won’t process any payments that are going outside of the US border. The rationale is ‘fraud’, even when you’re dealing with well-known and trusted vendors. Even when I try calling my banks and telling them to pre-authorize the charges, they won’t go through. The only way I can get around that within the established financial system is by using a 3rd party payment service; those 3rd party services make their money by lopping off a percentage of that purchase. E.g., if I’m buying something for $1000 from China (and we’re going to ignore tariffs, duties, taxes, and shipping costs for the moment), then I may have to pay $1040 for it, because of the fees that are taken out. On the other hand, if I’m buying from a trusted vendor, and I use bitcoin, I can just send it to them. Bitcoin doesn’t care where it’s going, and–assuming you don’t care about speed of confirmations–transaction fees can be quite a bit lower than using any other payment system. (And, BTW, transaction fees are built into all payment processing systems; it’s just not apparent to individuals on the purchasing end. That means that if something costs .001btc, then I have to send, say, .0010001btc to the vendor, but then the)

Speculation doesn’t play a role in it for me.

I have no direct use for gold; I can’t plate connectors.